Digital Transformation: Procure to Pay P2P

Dieter Weisshaar • August 8, 2020

Photo by Josh AppelonUnsplash

'Doing twice of the work in half of the time'

'The art of doing twice of the work in half of the time' is a book title from Jeff Sutherland the co-writer of the agile manifesto. Digital and automated procure to pay processes may have some small elements of agile but the key message is that the efficiency gain on a digitized procure to pay process

(P2P) should be in this range.

Why is procure to pay

a relatively easy first step into digital transformation?

- First, almost every company has a procurement process. It is not overly complex.

- Second, a lot of companies have not digitized the process yet or only parts of it but the benefit comes from an end to end solution.

What is an automated and digitized end to end

(E2E) procure to pay

process about?

Everyday a company receives invoices for something, someone has ordered. Already midsized businesses have five digit numbers of invoices. How is the traditional process run? Someone orders a service or a good at a vendor, best case your ERP system has already all vendors in place and the purchase order (PO) has been sent by letter or eMail. After a while you receive an invoice in regards to this PO. The invoice need to checked and booked into your accounting system. The process is highly manual, has repeatedly manual entries, a good chance for failure and little governance and control.

If you run a fully digitized P2P process, your business user is initiating the procure to pay process and it should proceed as follows:

1. Creation of a purchase order

The business user has a demand and creates a purchase request. The purchase request (PR) is assigned to a cost center or a project. It will be checked against the available budget. A supplier recommendation may be entered. Now the PR will be sent for approval through a fully digitized workflow based on rules to the relevant stakeholders (e.g. Purchasing). After approval, the purchase order (PO) is created and send automatically to the supplier. With this approval your purchasing and finance department has a real time view of cost which will occur in the coming periods.

2. Delivery of goods or service along with an invoice

At some point in time your company receives a delivery note, invoice and / or other documents. The documents will be either scanned on electronic receive (e.g. eMail) or physically.

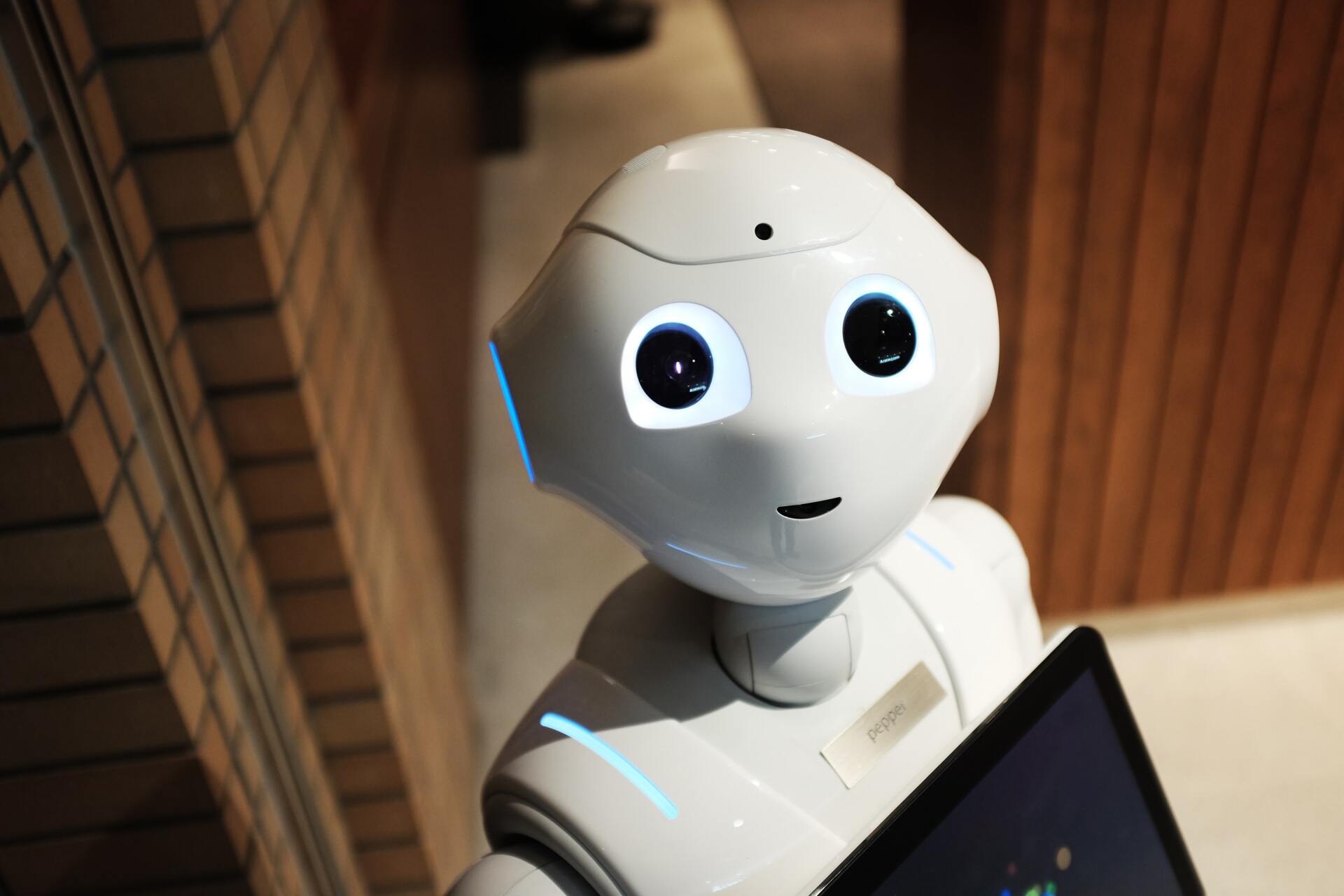

These electronic documents will now path the capturing and extraction process to capture and extract all relevant data in an automated fashion, such as the supplier, the bank account, the items, prices, taxes etc. Modern systems use artificial intelligence to get a high recognition rate to process the documents without manual intervention. Important at this point is that the systems can access the available information in e.g. your ERP systems such as vendor information, purchase order number to match the invoice to right the PO. If a deviation is recognized or a threshold is exceeded a workflow starts automatically to get this reviewed by the accountant, purchaser or management.

3. Booking of invoices

You have received your invoice and the business user may need to confirm the receipt of goods and services, this will be all done by a digital workflow or you don't need a confirmation, based on rules you can automatically approve the invoice. The approved invoice will be booked into your accounting system straight away, no need for manual work. All invoices are archived and available for review at any time. Governance and Compliance requirements can be easy implemented.

4. Governance, compliance and control

By having all data in a digital format, you can run all kinds of reports and create a dashboard to manage, forecast and control your process. Some areas you may look into is: spend by vendor, price per unit, approval cycle times, searching a PO in the process, invoices without PO etc. You will be able to spot potential overspent and fraud.

Side Remark:

If you use Artificial Intelligence (AI) beyond the data extraction task, you can benefit from even more automated and self learning workflows and exception handling. In addition you analytics and fraud recognition can be highly sophisticated.

Benefits for the company

You may think that the benefits is saving headcount in finance, accounting, purchasing that may be a business case but from experience, you gain even more by getting full transparency on your spend, the prediction, the compliance, the quality, the vendor selection etc.. User normally like the process as it is fast, transparent and easy to use. Ready for a digital workplace age.

How do I get there?

Good question, you should already have an ERP system in place and those are normally limited on handling documents and flexible workflows as required above. Hence you choose one of the procure to pay process platforms available in the market, there are many.

Ariba (c) from SAP (c) is potentially the largest one but most companies suffer by its complexity and cost. It has a certain target group. You may not even been in the position that you can dictate your suppliers how the PO process will be defined or how invoice need to look like hence you need a flexible system with a manageable complexity and cost that allows a good ROI.

A few checkpoints:

- Does the software vendor cover the required processes you need as mentioned above?

- Run a workshop on the requirements and match it with the recommended process by the software supplier. Do not overcomplicate the process and take advice to stay as close to standards as you can.

- Does the platform run as an application within your ERP system and is integrated or is it a separate application which connects to your ERP system? How good and deep is this integration to receive information and automate the process?

- Do you intend to run the whole process in the cloud and e.g. integrate vendors for biding as well on the long run or do you run this on premise in your own datacenter? Recap new versions of ERP systems will be more likely cloud based.

- How flexible is the workflow engine as workflows will change regualry? Can your business users (subject matter experts (SME)) change workflows by drag and drop on a user friendly interface or is that hard scripting from an IT Consultant?

- What is the capturing process about? Is it a static rule engine that is hard coded and every new document layout on a new vendor will create IT Consulting efforts or is it self learning and training by e.g. artificial intelligence (machine learning)?

- Do you have international invoices and documents in different languages, that adds complexity and need to be evaluated?

- Do you have different legal entities with different ERP systems? If yes, that should not cause a problem to run a centralized P2P platform, if your software vendor does support this setup. It has actually even bigger gains on transparency and compliance. You can manage the P2P process including cost and cash flow forecasts across your corporation despite local entities.

The next opportunities:

- Think about integrating

contract management on day one because your vendor may have a frame contract, a master supplier agreement and other legal documents. This is a highly paper driven process and should be included as soon as possible.

- Do you need your suppliers

bidding

for a Request for proposal (RFP), that can be done online, is this possible with the platform chosen?

- You capture, extract documents and archive them during the process. Can this technology being used by e.g. HR to capture work contracts to get to a digital employee file?

- You can implement to rank your vendors on quality, experience etc.

Implementing an automated and digitized end to end procure to pay process creates great and fast benefits for most companies. It is a must in a digital transformation and low risk if it's done right. The ROI

should be less than one year

otherwise the implementation is too complex or the selected platform too complicated.

Your business user will love you for an easy and user friendly process. Just get started.

On our famous online book store you find far over 60.000 books on strategy but only a good 4.000 on strategy execution or implementation. There are far more universities that offer marketing and only a few on sales as a major. Creating the ambition, the project goals, the strategy is a cool thing and requires great thinkers. Taking the things to daily execution requires an additional skill which is rare, may be perceived as boring but is the key success factor for every company.

You receive a new project and on the first view it looks complex and you need to get your arms around it. How can you structure a complex situation to discover various perspectives and approaches. At C-Level you may not even have all the information or expertise to resolve it on your own. Some ideas that worked for me.

You may have seen the rise of tech companies at the end of 90th of last century. Web Content, eCommerce and startups were the exciting topics, til the point when the dotcom bubble burst. It was the time when salaries went crazy in this sector, the company evaluations and stock markets were on all time high and venture capital market was overheated.

Marketing budgets are always a discussion topic. What can a CEO expect if a percentage of revenue is spent for corporate marketing? Have the goals been defined and expectations aligned. Marketing can not meet expectations if the ecosystem is not supportive. Let's have a deeper look in the B2B sector and the dependencies.

Every single day, when you open Social Media, you got told that there is a New Work and new leadership skills. It is indisputable that leadership has changed from decades ago and that is rightly so. In the light of the new resignation and war for talent, great leadership skills are fundamental for every company. But we should not miss out Expertise as a skill.